utah non food tax rate

But they have also repeatedly alluded to Winder and Brooks proposals as what will likely surface in the House when lawmakers consider Sen. Sales tax rates at taxutahgovsales 62001 9998 TC-62S Rev.

From Multiple Layered Taxes To 1 Nation 1 Tax The Journey Of Indian Tax Structure Indiantaxation History 1nation1ta Journey India Latest News National

The state rate is 485.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. That means the actual rates paid in Utah range from 610 to 905. The Utah income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022. January 1 2008 December 31 2017.

This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice.

20K otherwise Convicted felons in state prison for any portion of the year are ineligible. This is a combined rate including 175 of state tax 1 local option and 025. January 1 2018 Current.

Utah has a higher state sales tax than 538 of states. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or. Use the Use Tax Rate List below to get the rate for the location where the merchandise was delivered stored used or consumed.

Tax years prior to 2008. Detailed Utah state income tax rates and brackets are available on this page. 89 rows These rate charts are not intended to be used by non-nexus filers to source out-of.

However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. Utahs Three Major State and Local Taxes. Both food and food ingredients will be taxed at a reduced rate of 175.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. What is the tax rate on food in Utah. Alabama Income Tax Rates for 2022 maintained a place of abode in Utah and spent 183 days or more in the state during the year.

Out-of-state sellers should source their sales based on the ZIP 4 of the customers address. Utah has a 485 statewide sales tax rate but also has 128 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2108 on top of the state tax. See the instruction booklets for those years.

As well as individuals living in the state under a visa Yes 37000000 2016 GROCERY CREDIT. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. Income Property and Sales Use Tax Revenues FY 2014 Property 2768460738 28 Sales Use state.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. If a locality within a county is not listed with a separate rate use the county rate. Sales and use tax rates vary throughout Utah.

They say both proposals would target needy Utahns both those on fixed incomes and those making low or middle incomes. While the sales tax on groceries and motor fuel would increase for Utah residents income tax credits and the overall income tax rate would decrease from 495 to an anticipated 464 according. Utah has a single tax rate for all income levels as follows.

The capital gains tax. Real State Sales Tax Revenue Real Non Farm Wages 170M Sales Tax Cuts Food Rate Other 2007 2008 2009 35M Rate Reduction 1998 Rate Increase from 40 to 4625 1984 30M Rate Reduction Other Rate Increase from 1995 46 to. If you are a nonresident of Utah stationed in.

Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food. Two years ago as a private citizen Rosemary Lesser was part of a grassroots crusade that stopped the state legislature from raising sales taxes on food. In resort communities the Resort Exempt rate is the Combined Sales and Use tax rate minus the resort community tax.

Non-food and prepared food sales X taxable sales tax rate b. In the state of Utah the foods are subject to local taxes. The tax on grocery food is 3 percent.

With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more. He added that food stamp participants dont pay sales tax on food stamp purchases now and if the basic sales tax rate on non-food items goes from 525 percent to 635 percent the CurtisUrquhart off-set to keep the state from losing 225 million the sales tax becomes more regressive because they pay more on other retail items. 1015 Single Place of Business a.

Dan McCays bill to drop Utahs income tax rate from 495 to 485. If purchasing groceries in Utah youll see a 3 tax added to your grocery receipt for general food sales. OK450 050 - 500 40 per household member Full year 50000 for the elderly disabled and individuals with dependents.

274 rows Utah has state sales tax of 485 and allows local governments to collect a local. For more information see https. The top rate income tax rate also went from 66 to 59 for 2021 and it drops again in 2022 to 55 and 2023 to 53.

There are both state and local sales tax rates in Utah. Grocery food sales X taxable sales tax rate original ustc form. Local rates which are collected at the county and city level range from 125 to 420.

Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. These rate charts should not be used for sourcing sales from out-of-state sellers to locations in Utah. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

January 16 2022 519 PM. This legislator wants it to be null. Tax years prior to 2008.

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

Sales Tax On Grocery Items Taxjar

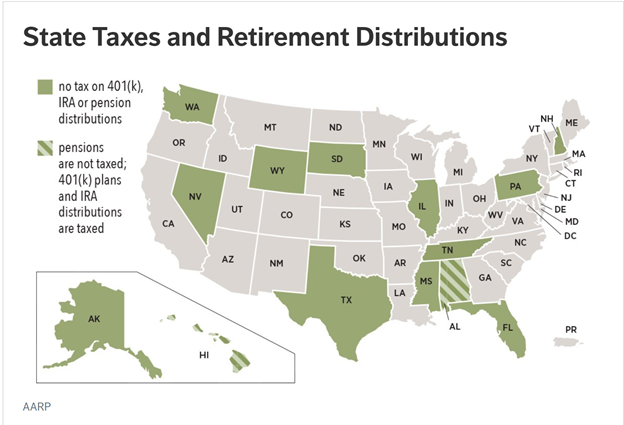

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

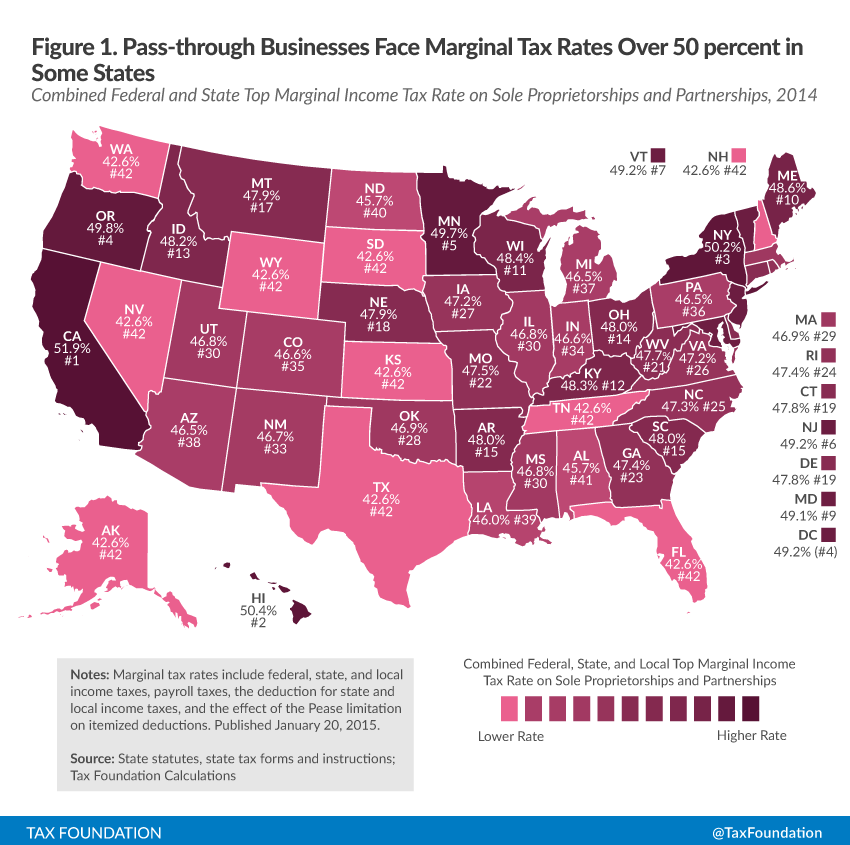

An Overview Of Pass Through Businesses In The United States Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

Utah Sales Tax Rates By City County 2022

Utah Sales Tax Small Business Guide Truic

How To Charge Your Customers The Correct Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

State Income Tax Rates Highest Lowest 2021 Changes

States With The Highest And Lowest Property Taxes Property Tax High Low States

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation